The Early Stage of AI in Finance

Artificial Intelligence is revolutionizing business but in finance, it’s still early days. Many CFOs are exploring how AI can make their departments more strategic, efficient, and forward-looking.

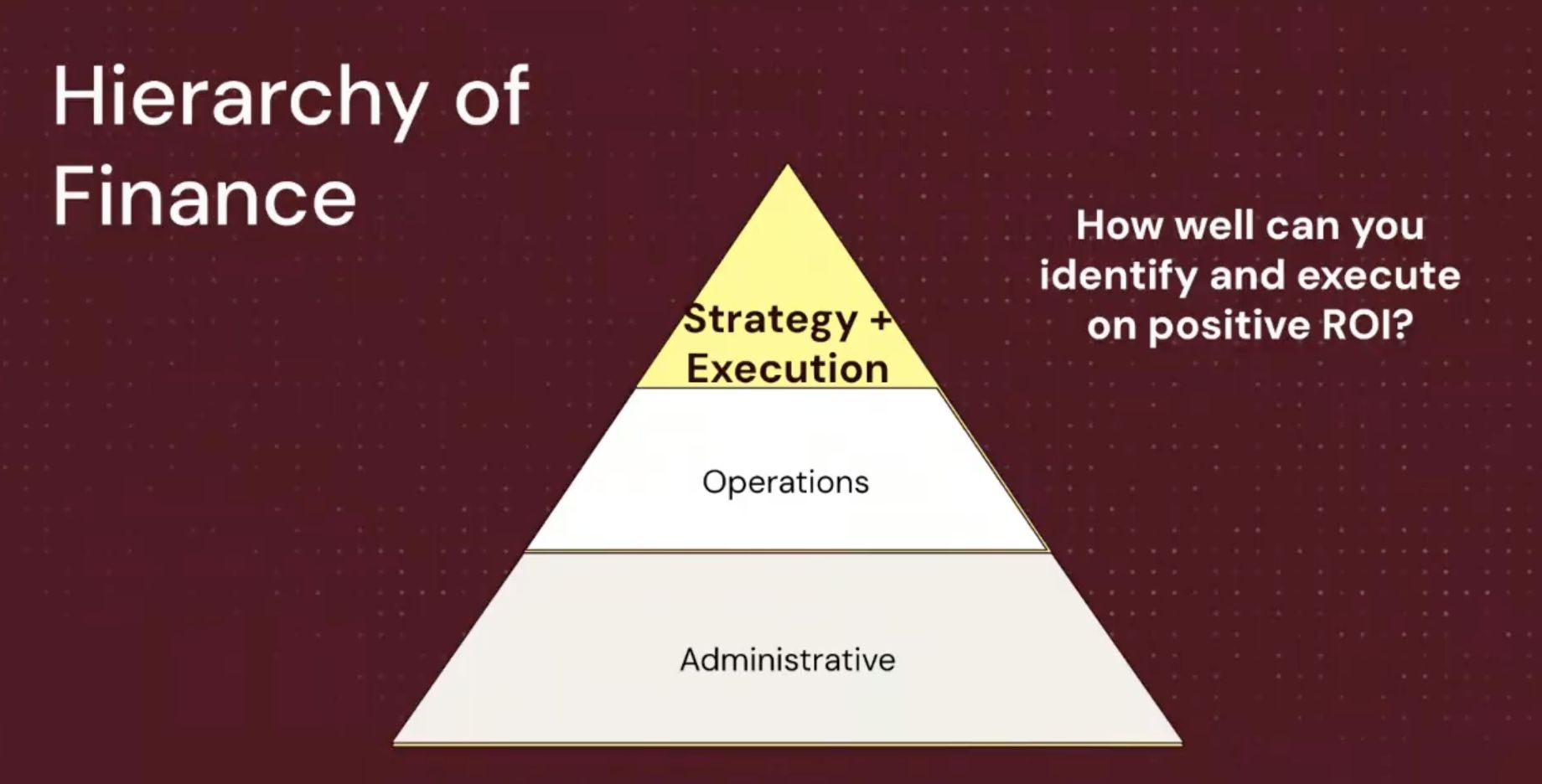

A useful way to think about adoption is through a “hierarchy of finance” framework. This approach prioritizes high-impact strategy and execution while using AI to automate repetitive, low-value tasks.

Instead of replacing people, AI empowers finance teams to spend more time on meaningful work: planning, decision-making, and driving growth.

Practical AI Use Cases for Finance Teams

Finance teams can adopt AI in two main ways:

- Enterprise-level integration: implementing AI-driven ERP systems that centralize and automate data management.

- Incremental automation: starting small with tools that streamline accounts payable, cash flow management, or reconciliations.

AI delivers the most value when it takes over repetitive operational work, freeing professionals to focus on strategy, forecasting, and analysis.

What Are AI Agents and Why They Matter

AI agents are the next evolution of automation. Unlike traditional AI tools that simply respond to prompts, AI agents can perform tasks, such as retrieving data, updating spreadsheets, or matching invoices with communications.

They act like digital co-workers that handle time-consuming processes behind the scenes. This capability makes them ideal for finance teams that deal with large volumes of data and repetitive reporting tasks.

For example, Daylit's AI agents collect, reconcile and forecast so you don't have to. Built to chase late invoices, resolve disputes, post cash with clean remittance, and update 13 week forecast in real time, Daylit's agents save you time across your working capital cycle.

Measuring ROI on AI Investments

CFOs naturally look for measurable results. When it comes to AI, the return on investment (ROI) isn’t only about cost reduction; it’s also about time recovery.

Every hour saved from manual work is an hour that can be reinvested into strategic decision-making or growth initiatives. Over time, this shift creates compounding returns and enables teams to scale more efficiently without increasing headcount.

The Human Advantage: Productivity and Well-being

Beyond efficiency, AI can significantly improve the work experience. Automating administrative tasks reduces constant context switching, helping teams focus better and stress less.

An AI-augmented finance function can integrate both top-down and bottom-up data for real-time forecasting, allowing leaders to make faster, more confident decisions.

Building an AI-Native Finance Team

Successfully adopting AI requires more than just new tools, it calls for a new mindset. Finance teams must ensure data security, compliance, and transparency, especially in regulated industries.

Choosing vendors with SOC 2 certification and strong governance standards helps safeguard data. Becoming AI-native is a gradual process: learning continuously, testing new technologies, and embedding AI into everyday workflows.

From Cost Center to Growth Engine

AI is redefining the role of the CFO. By automating manual tasks, finance departments can transition from managing budgets to driving value creation.

Future finance teams may operate more like investment partners; focusing on acquisitions, capital allocation, and profit optimization rather than routine accounting. With AI, finance evolves from a cost center into a strategic growth engine.

Managing Risks and Encouraging Collaboration

AI brings incredible potential but also new risks, such as data breaches and cybersecurity threats. Starting with small, controlled implementations helps minimize exposure while building confidence.

Cross-functional collaboration is also critical. Finance teams can accelerate adoption by learning from IT, sales, and marketing departments that have already integrated AI tools into their workflows.

Final Thoughts: The Future of Finance Is Human + AI

AI is not about replacing finance professionals, it’s about amplifying human expertise.

By combining automation with strategic insight, CFOs can unlock new levels of efficiency, agility, and growth.

The future of finance belongs to teams that embrace AI early, experiment fearlessly, and use technology to elevate their impact. To learn how Daylit's AI agents can help with tedious tasks of A/R, book a meeting with our team today.

{{book-a-free-consultation-with-daylit}}