Working capital line of credit for smooth operations

With DrawDown, you can draw larger amounts of cash for your growth projects without dilution.

Get reliable working capital

Use non-dilutive capital to grow your business

Scale without giving up equity

Preserve your business' equity as you invest in growth.

Transparent and fair rates

Only pay fees on what you draw, no early prepayment penalties.

Fast and easy application

Apply online in minutes without any tedious paperwork.

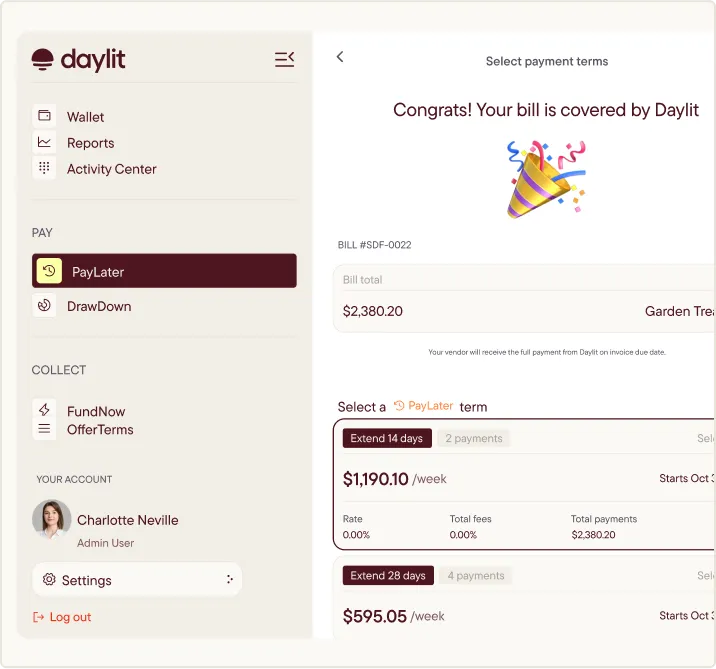

How getting working capital for big purchases with DrawDown works

This is the default text value

Whether it's an urgent purchase or growth opportunity, you decide on the amount of line of credit you need.

You decide on the term length to pay Daylit back.

There's no penalty for paying back early.

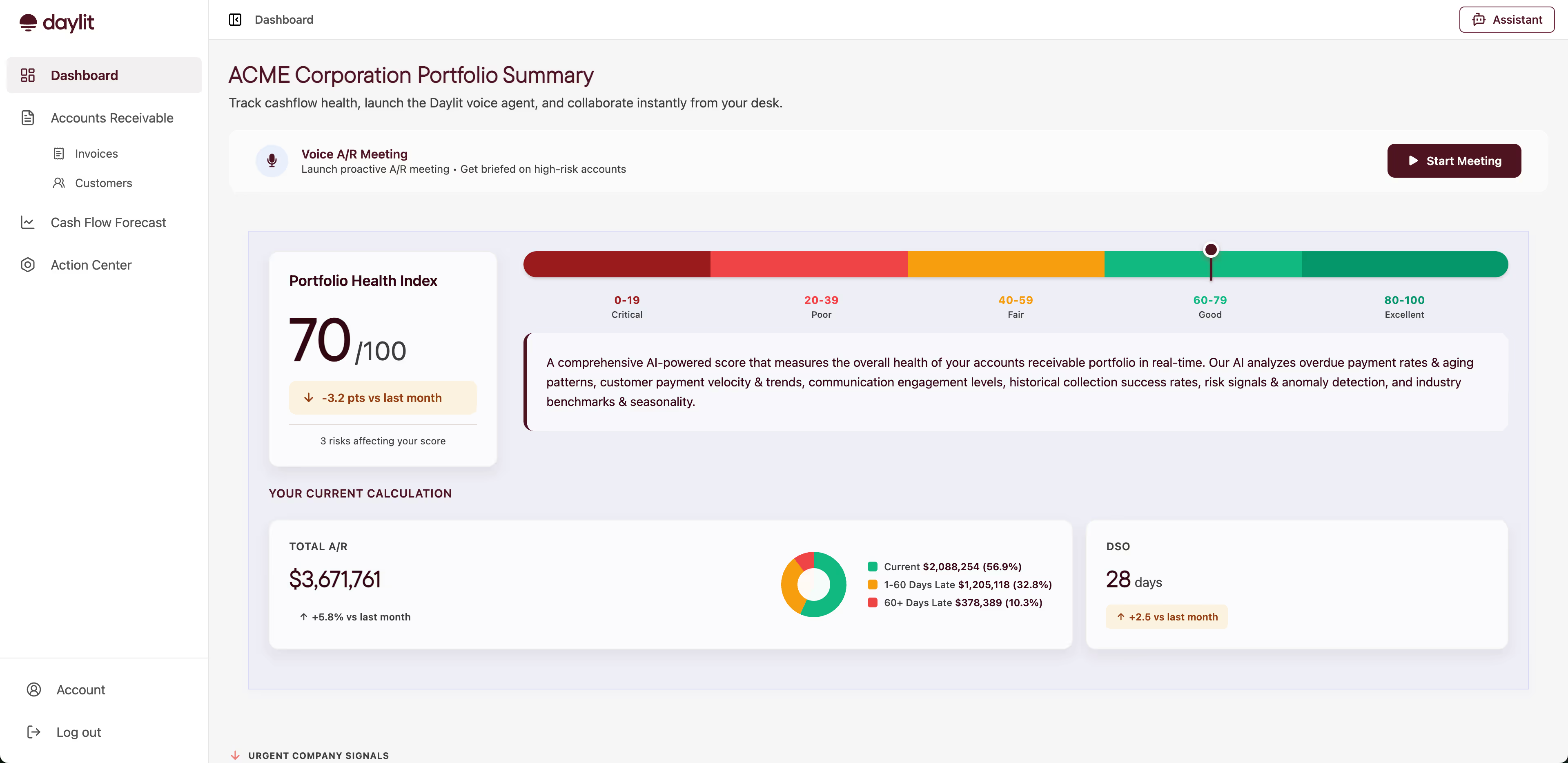

Accounts receivable just got brighter

Get paid on time, every time, with an all-in-one platform that transports your accounts receivable operations into the AI-era within days of going live.

Easy to use platform

Simple, intuitive platform built for operators with busy schedules.

AI agents around the clock

Your own AI agents to actually do the work alongside your team.

Always on and ready

We are live 24/7/365 and ready to support.

Built-in finance

Liquidity is no longer an issue on any slow paying customer invoice.

Security is in our DNA

We ensure that your data is fully protected and handled with care.

See into the future

Upgrade from reactive A/R support to proactive A/R intelligence.

What our customers say

Companies across industries, from chemicals and specialty contractors to healthcare, trust Daylit to optimize their working capital.

You’ve got questions, we’ve got answers

Daylit is a next-generation approach to Accounts Receivable. It centralizes customer payment behavior, predicts cash flow, surfaces risk, and automatically drives the next best action for A/R teams. It’s the intelligence layer that transforms A/R from a reactive collections function into a strategic part of finance.

Most A/R tools focus on workflow automation, dunning, or dashboards. Receivables Intelligence goes further by providing a source of truth for what is owed, why, and what needs to happen next. It eliminates manual reconciliation work, aligns teams, and generates true insights leadership can act on.

Daylit is designed for CFOs, controllers, A/R managers, and collections teams who want a more predictable, data-driven approach to cash flow and customer payments. It’s built for organizations that want to eliminate manual processes and move toward strategic

Daylit addresses the biggest pain points across finance and A/R teams, including unpredictable cash flow, fragmented systems, lack of visibility into customer behavior, manual reconciliation work, and chaotic weekly A/R meetings.

Daylit is designed to centralize data from the systems teams already use, including most ERPs, CRMs, email, and spreadsheets. We currently support integrations with Netsuite, Quickbooks, Microsoft Dynamics, ZohoBooks, Freshbooks, and several more.

By eliminating manual reconciliation, surfacing risk early, and telling teams exactly where to focus, Daylit removes the friction that slows down collections. Teams spend less time searching for answers and more time driving outcomes.

Latest insights about accounts receivable

We have inspiring case studies, industry reports and cash flow management tips for you.

Accounts receivable just got a little brighter

Get paid on time, every time, with our all-in-one platform that transports your A/R into the AI-era within days of going live.