Which Embedded Lending Platform is Right?

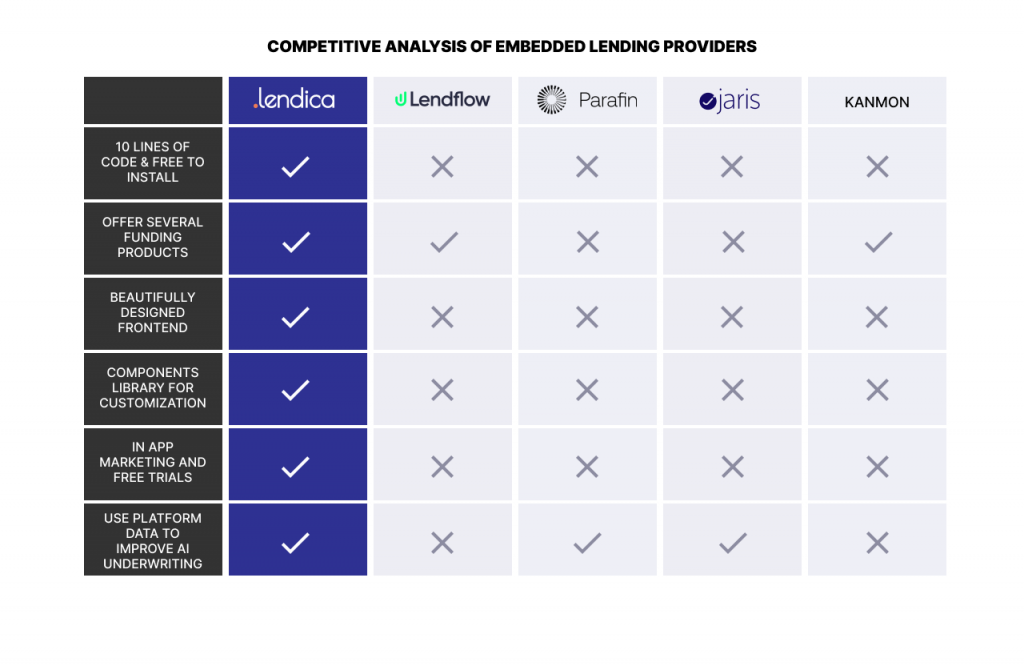

There are five major companies serving the embedded lending space: Daylit (formerly Lendica), Lendflow, Parafin, Jaris, and Kanmon.

Based on our experiences embedded lending products over the past several years, we have found the top five categories that companies (Vertical SaaS, POS, ERP, Marketplace, eCommerce, etc) look for when making their embedded lending decision.

These categories include

- Speed and ease of installation

- Product design and functionality

- Loan products, approval rates, and terms

- Ongoing costs to market the product to their customers, and

- Continuous platform improvement

We compare all five companies and conclude that Daylit (formerly Lendica), Lendflow, and Parafin have advantages in the following categories.

- Best embedded solution: Daylit (formerly Lendica)

- Best embedded broker: Lendflow

- Best alternative to Daylit: Parafin

Easy to Install

The first step to consider is the cost to install your embedded lending solution. There are explicit and implicit costs to be aware of. The embedded lender may offer the installation for free, such as Daylit, and generate its revenue on success (i.e earning fees for good loans). Be warned that some solutions, Lendflow for example, will charge upwards of $1,200 per month to install the service.

The implicit cost is typically much higher. Some embedded lending solutions, such as Kanmon, can be quite labor intensive to install. Companies seeking to embed lending products should be aware of the development time spent to build the integration. Daylit's embedded lending product is designed to be “off-the-shelf” with the ability to customize. Partners can actually install Daylit with just a few lines of code and it can be activated in minutes. To demonstrate, we bought a Tesla with Daylit in just a few minutes.

Based on our analysis of integration time and explicit cost, we estimate that most software companies can be up and running, at scale, with Daylit (formerly Lendica) 10 times faster and most cost effective than most other embedded lenders.

Simple to Use

An important next step to consider is the product design and use. Aesthetic appeal in software isn’t just about good looks—it can greatly influence user behavior. An appealing, modern interface attracts customers and entices them to explore further. Daylit’s product is visually engaging and designed with user experience in mind. This ensures customers feel comfortable and attracted to the software, thereby increasing the probability of continued usage and loyalty.

Ease of use is another significant determinant when choosing software solutions. The ability for users to understand and navigate the product efficiently without needing extensive training or support is crucial. The more questions your customers ask, the most expensive the embedded solution becomes as it requires servicing and updates. With an intuitive interface and features, Daylit significantly reduces the learning curve for new users. This accelerates the adoption process, saving software companies valuable time and resources, and leading to quicker returns on their investment.

Design is a difficult category to quantify, so we invite you have a look at Daylit’s product and decide for yourself.We estimate that, aside from a design advantage, the intuitive and inviting nature of Daylit's product can dramatically increase conversion by more than 10x compared to other embedded lenders.

More Customer Approvals

There are two factors that the decision-maker should consider as it relates to approvals: product mix and underwriting strength. More products equate to more approval opportunities, catering to a broader range of customer needs. Daylit’s approach in offering four funding products demonstrates its understanding of varied customer profiles and their unique requirements. Unlike some platforms such as Jaris and Parafin, which only offer merchant cash advances, Daylit ensures flexibility and inclusivity by providing a broader product mix.

Lendflow, although not a direct lender themselves, does offer customers a wide variety of funding products through its broker network. End customers that are interested in a loan will share some data with Lendflow which will in turn market their business file to its audience. It should be noted that while this does widen Lendflow’s product offering, it does dramatically increase the costs to the end-customer.

Strong underwriting methodologies are key to the success of any lending platform, as they contribute to lower rates by reducing defaults. Daylit’s AI-powered underwriting engine incorporates partner platform data, thereby gaining a more detailed and accurate understanding of risk. This information-driven approach leads to a robust underwriting process and therefore industry-leading approval rates. Parafin, although focusing on only one funding product, does tend to use platform data to make underwriting decisions similar to Daylit.

Built-in Marketing

The ongoing marketing efforts towards the end customers in the embedded lending space can indeed pose significant costs and time expenditure. Companies considering embedded lending should assess the marketing budget to nudge the customers towards the product.

We believe Daylit is the only embedded lender directly address this concern by integrating a unique in-app marketing engine. This feature serves a dual purpose – it substantially reduces the associated marketing costs and concurrently enhances customer engagement. Daylit’s built-in marketing engine eliminates the need for separate, costly marketing initiatives. Instead, it delivers relevant, targeted messages and prompts within the app interface itself, keeping customers informed and engaged, which ultimately fosters a deeper relationship with the user. Importantly, these features are customizable and can be turned on/off as directed.

Daylit also offers in-app campaigns, including free trials, designed to entice potential customers and provide them an opportunity to experience the product first-hand. This proves to be a powerful conversion tool – customers can get up to $10,000 free to try – and comes at no cost to the partner.

The goal of these in-app marketing features is to improve the per-dollar conversion by 100x any other embedded lender. We believe that this is currently the case.

Continuous Innovation

When you embed a lending product, you are not just betting on a great service today, but rather a great service for years to come. For that reason, Daylit remains focused on continuous innovation.

Each new feature Daylit develops is guided by three fundamental questions. First, will it enhance the customer’s embedded experience? Second, can it reduce the costs per conversion for the partners? And third, does it have the potential to change how small businesses access financial services? These considerations ensure that Daylit's enhancements not only serve immediate needs but also propel the future of small business financial success.

Choosing Daylit is not simply a choice for today; it’s an investment in a service that evolves and adapts to future needs. The rapid progression of the fintech industry necessitates a responsive and proactive approach to innovation. Daylit embodies this by continually improving its services to meet and exceed the changing needs of customers and partners. As such, the decision to embed Daylit’s lending product is a commitment to long-term growth and transformation.

Conclusion

In conclusion, the future of embedded lending clearly lies in services that are fast, efficient, user-friendly, and innovative. Daylit is at the forefront of this evolution, with its quick and easy installation, sleek product design, improved loan approval rates and terms, reduced marketing costs, and soon-to-be-unveiled AI enhancements. It’s not just about providing a service but creating an ecosystem where businesses can flourish with minimal barriers and maximum support. While competitors may offer pieces of the puzzle, Daylit brings them together, presenting a complete picture that is greater than the sum of its parts. This is why we confidently say Daylit provides a 10x advantage. Embrace the future of embedded lending with Daylit, and experience a seamless financial journey tailored to your unique business needs.

{{embedded-finance-learn-more}}